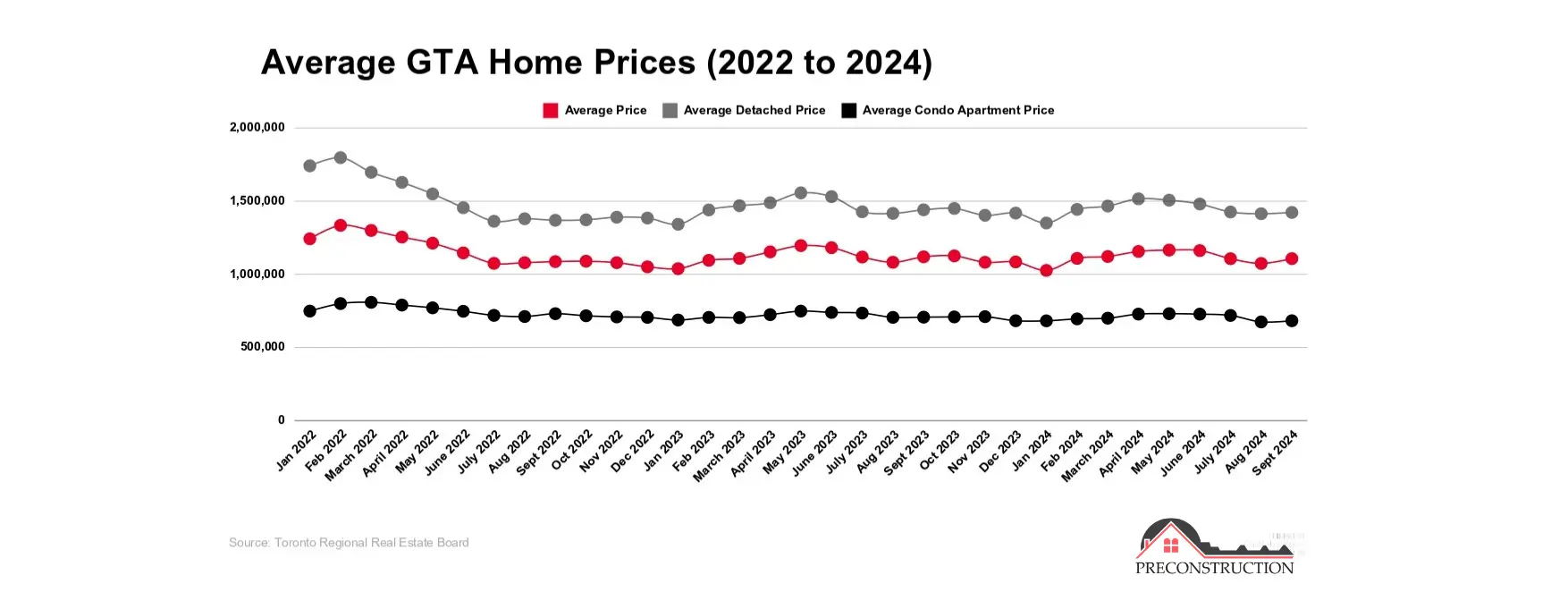

Toronto Home Prices – Toronto’s housing market is one of the most dynamic and competitive in North America. For years, this market has been marked by consistently rising prices, fueled by high demand, limited supply, and a vibrant urban lifestyle that continues to attract buyers. However, as home prices keep climbing, the recent dip in interest rates, which would normally help buyers save, may not be enough to offset the overall cost of homeownership in the city.

In this blog, we’ll explore how rising home prices in Toronto are beginning to counteract the financial relief that lower interest rates might provide. Whether you’re a first-time buyer, an investor, or just a keen observer of the housing market, understanding this dynamic will be crucial as you navigate Toronto’s real estate landscape.

Historical Context of Toronto’s Real Estate Market

To appreciate the current situation, it’s essential to understand Toronto’s historical real estate trends. Over the past decade, the city’s housing market has experienced rapid growth. Some key factors driving this growth include:

- Population Growth: Toronto’s population has grown consistently, with people moving from both within Canada and internationally. With population increases come a greater demand for housing, creating a supply imbalance.

- Economic Stability and Growth: Toronto is Canada’s financial hub, providing steady employment opportunities and economic resilience. As job prospects attract workers, the demand for homes continues to rise.

- Foreign Investment: Toronto has long attracted foreign investors, drawn to Canada’s political stability and economic prospects. While regulations, such as Ontario’s Non-Resident Speculation Tax, have been introduced to control foreign investment, this interest still impacts pricing trends.

- Urban Appeal: Toronto’s cultural and lifestyle offerings add to the desirability of living in the city. Areas like the downtown core and trendy neighborhoods like Liberty Village and Queen West have seen substantial development, further driving up demand.

Historically, these factors have maintained high property values, even as mortgage rates have fluctuated.

How Lower Interest Rates Typically Benefit Homebuyers

When interest rates fall, homebuyers can benefit in several ways. Lower mortgage interest rates generally mean:

- Lower Monthly Payments: A lower rate reduces the overall interest cost on a mortgage, which decreases monthly payments, making homeownership more affordable.

- Increased Purchasing Power: Lower interest means buyers can afford higher-priced homes, as they are approved for larger mortgage amounts within the same budget constraints.

- Attractive Refinancing Options: For existing homeowners, reduced rates provide a chance to refinance their mortgage at a lower rate, saving money on monthly payments.

This easing of costs often incentivizes more buyers to enter the market, contributing to increased competition and potentially driving prices higher as demand surges.

Why Toronto’s Home Prices Are Rising Despite Lower Interest Rates

Several unique factors continue to drive Toronto’s property prices upward, even as interest rates dip:

Supply-Demand Imbalance

The city faces a significant imbalance between housing supply and demand. Toronto has stringent zoning regulations that limit the types and amount of housing that can be built in specific areas. This regulation restricts the number of homes available, particularly in high-demand neighborhoods close to downtown.

Economic Factors and Inflation

High inflation rates have impacted construction costs, raising prices for materials, labor, and logistics. These additional expenses are often passed on to buyers, which further drives up property costs. Rising costs for everyday goods also affect household budgets, leaving fewer funds available for potential buyers.

Foreign Buyers and Investor Demand

Despite restrictions on foreign buyers, interest in Toronto real estate from investors remains strong. Toronto’s property market is still a preferred destination for global investors looking for stable returns, particularly in the condo market.

Urban Migration Trends

The pandemic saw a trend of remote work and relocations, with some people leaving urban areas. However, as the workforce re-adapts, many are moving back to Toronto to be closer to work and city amenities. This return has rejuvenated demand in the downtown area, driving up prices in these neighborhoods.

The Scarborough housing market is buzzing with interest in this unique listing at 28 Bobmar Road.

The Impact of Rising Home Prices on Homebuyer Savings

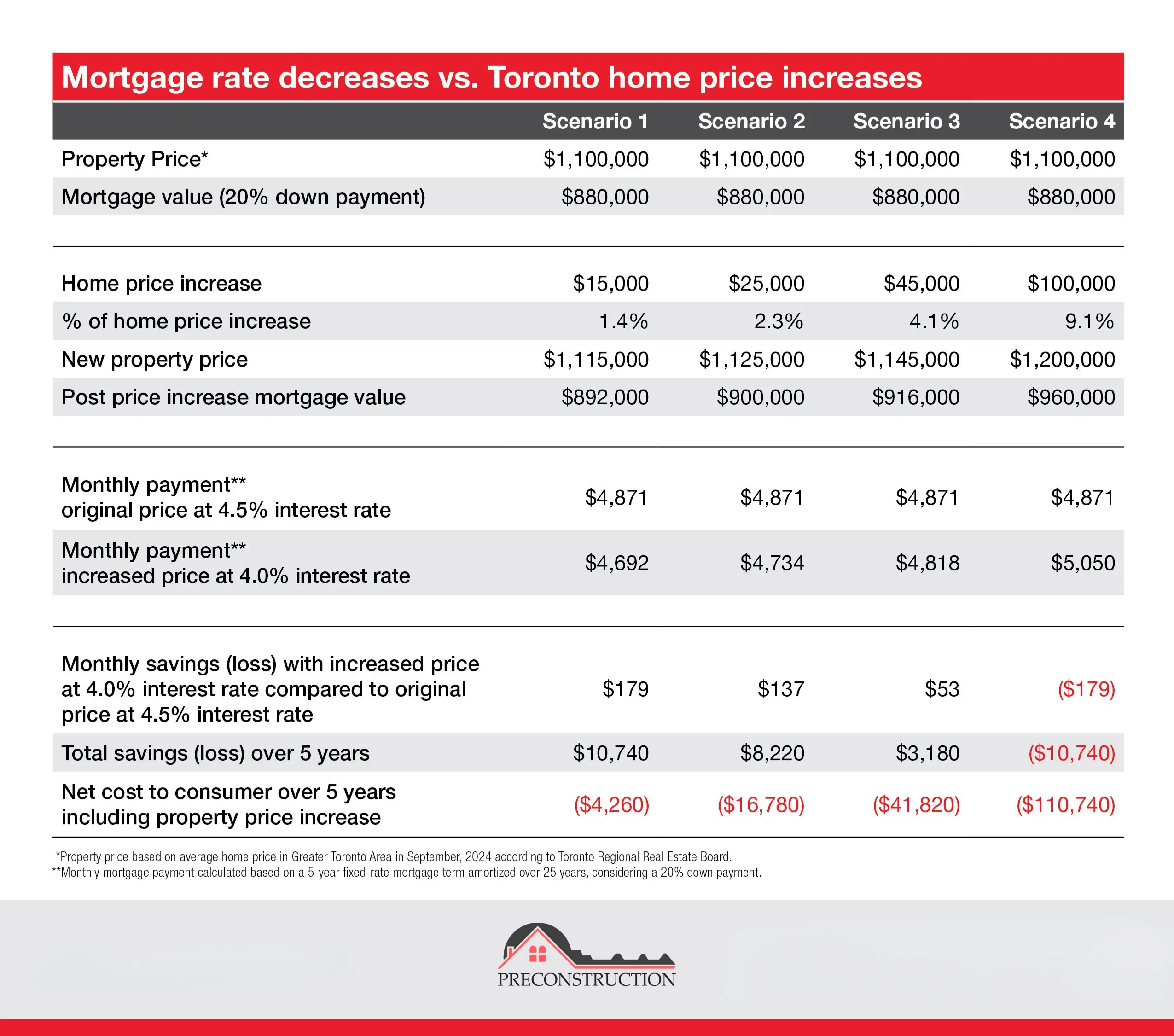

While lower interest rates would theoretically offer homebuyers financial relief, Toronto’s rising prices effectively negate these savings.

The Affordability Gap

As home prices increase, the affordability gap grows wider. Lower rates do little to help buyers if prices climb disproportionately. For example, a small dip in the interest rate may reduce monthly mortgage payments slightly, but when the purchase price increases by hundreds of thousands, this discount becomes negligible.

Case Study: Monthly Payment Comparison

Let’s take an example to illustrate this:

- 2022: Average home price in Toronto was around $1,000,000 with an interest rate of 3.5%.

- 2024: Average home price increased to $1,200,000, but the interest rate dropped to 2.5%.

While the interest rate is lower, the monthly payment on a $1.2 million mortgage remains significantly higher than it would have been at the lower price point with a slightly higher rate. Rising prices nullify the benefit of decreased rates, making it difficult for buyers to achieve meaningful savings.

Mortgage Stress Testing

Canada’s mortgage stress test, designed to ensure buyers can handle rate increases, adds another layer of complexity. As prices rise, many buyers are unable to qualify for the necessary loans under the stress test criteria. This policy effectively pushes buyers out of the market or forces them to purchase less expensive, and often less desirable, properties.

Financial Forecasting and Market Predictions for Toronto

Industry experts predict Toronto’s housing market will remain competitive, with prices continuing to climb, albeit at a slower rate due to market pressures and possible regulatory intervention.

Short-Term Predictions (1-2 Years)

- Moderate Price Growth: Prices are expected to grow moderately due to existing supply constraints and population growth.

- Interest Rate Adjustments: The Bank of Canada may consider slight adjustments to interest rates based on inflation and economic performance, though any major decreases are unlikely.

Long-Term Forecast (5+ Years)

- Continued Demand in Central Areas: The demand for properties in Toronto’s core areas, especially near workplaces and transit, is likely to persist.

- Potential Government Interventions: The Ontario government may introduce measures to improve affordability, such as incentivizing new development or implementing more stringent controls on investor purchases.

- Greater Emphasis on Affordability Solutions: Affordability solutions may become a focal point, with efforts to support lower-income homebuyers and curb unsustainable price increases.

Discover the latest trends in the Toronto real estate market with Wedu, your trusted source for Ontario MLS listings and expert property analysis. For comprehensive insights into the pre-construction market in Toronto, check out Preconstruction Info to stay informed about new developments and investment opportunities. Enhance your property listings with stunning real estate photography services in Toronto from Click Media Pro.

Tips for Homebuyers Navigating Toronto’s Market

Despite these challenges, there are strategies that buyers can employ to navigate Toronto’s challenging market:

- Save More for a Down Payment: A larger down payment reduces monthly payments and increases purchasing power. Consider ways to boost savings, such as investing in high-interest savings accounts or low-risk investments.

- Consider Alternative Neighborhoods: Explore emerging neighborhoods with potential for future growth, like those in the East York or Scarborough regions.

- Opt for Pre-Construction Properties: Buying pre-construction can sometimes provide better pricing and favorable payment plans.

- Leverage Buyer Incentives: Look for developer incentives or programs like first-time buyer credits that reduce costs.

Long-Term Implications of Rising Home Prices

The upward trend in home prices impacts Toronto’s economy and the social fabric of the city:

- Impact on Rentals and Affordable Housing: As homeownership becomes less affordable, more people turn to rentals, driving rental rates higher and intensifying the need for affordable housing solutions.

- Economic Consequences: Higher housing costs can deter new talent and businesses, particularly those in need of affordable workforce housing.

- Potential Government Measures: Over time, government agencies may step in with stronger regulations aimed at balancing the housing market, such as enhanced zoning flexibility or new tax policies targeting vacant properties.

Conclusion – Toronto Home Prices

The interaction between Toronto’s rising home prices and falling interest rates creates a challenging environment for buyers. Despite lower interest rates, the market’s affordability remains out of reach for many, with price increases outpacing savings. As potential buyers face difficult decisions, it’s essential to weigh these trends and plan accordingly.

The hope is that over time, market forces or policy changes will address some of these challenges, offering greater affordability to homebuyers. For now, those looking to purchase in Toronto should remain informed, strategize carefully, and stay updated on policy changes that may impact the market in the coming years.