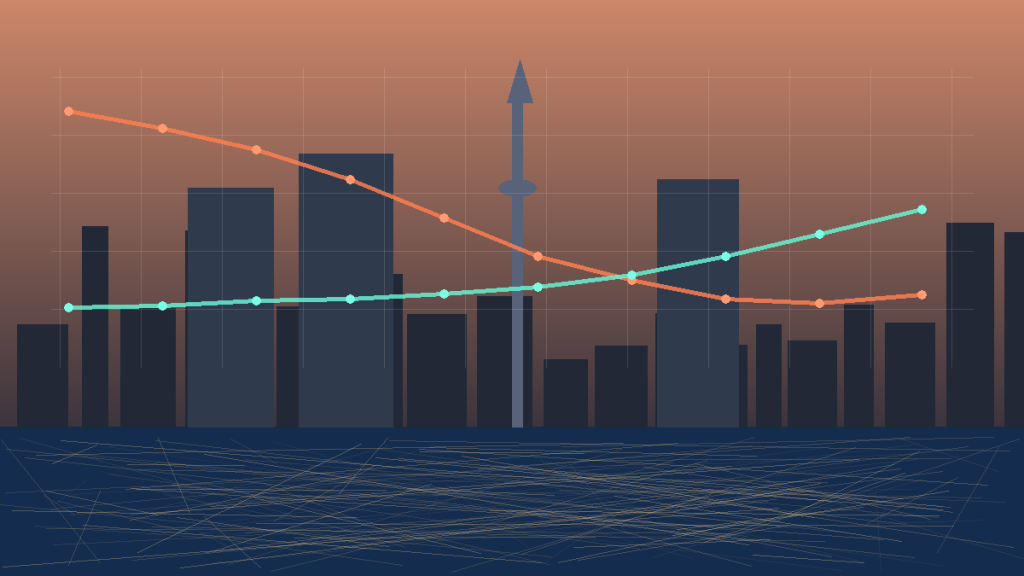

Toronto’s condo market has gone through a sharp correction, and many buyers, investors, and sellers are asking the same question: when will Toronto’s condo market hit bottom?

The honest answer is that no one can call the exact month. But there are reliable indicators that can help you identify when the market is stabilizing and when risk starts to improve. This guide explains what is driving the downturn, what buyers should watch, and the biggest mistakes to avoid while waiting for a bottom.

Toronto Condo Market Snapshot

Recent market conditions have been defined by slower sales, longer time on market, and weaker investor sentiment. Listings have taken longer to move, pricing pressure has increased in some segments, and many market participants are more cautious than they were during peak years.

- Buyers are waiting for clearer pricing and rate direction

- Some investors are facing weaker cash flow and softer rents

- Higher carrying costs continue to pressure leveraged owners

- Inventory in certain condo segments remains elevated

What Is Driving the Condo Market Correction?

1. Affordability and Financing Pressure

Higher borrowing costs and tighter lending conditions have reduced purchasing power. Even when buyers qualify, many are choosing to wait for more certainty before committing.

2. Slower Investor Demand

When rent growth slows and financing costs stay high, investor math becomes less attractive. That can reduce demand in investor-heavy condo buildings and submarkets.

3. Elevated Supply in Some Segments

More resale listings and ongoing completions can put short-term pressure on pricing, especially where product is less differentiated or heavily concentrated in smaller investor units.

4. Confidence and Sentiment

Real estate cycles are heavily influenced by confidence. Negative headlines, economic uncertainty, and fear of buying too early can delay demand even when some values begin to improve.

When Will Toronto’s Condo Market Hit Bottom? 5 Signs to Watch

Instead of trying to guess the exact bottom, focus on a combination of indicators that often appear before a sustained recovery:

- Sales volume starts rising consistently over multiple months

- Days on market declines and listings begin moving faster

- Lease rates stabilize or resume steady growth

- Inventory levels tighten in key condo submarkets

- Price per square foot stabilizes before trending higher

When several of these indicators improve together, it usually signals that the market is moving from correction toward stabilization.

7 Proven Mistakes to Avoid While Waiting for the Bottom

1. Waiting for a Perfect Bottom Price

Most buyers and investors miss the exact bottom. A better strategy is to buy quality units when fundamentals improve and pricing still offers value.

2. Ignoring Building Financial Health

A lower purchase price does not compensate for poor reserve funds, mismanagement, or ongoing legal issues. Review status certificates and building financials carefully.

3. Buying Based Only on Price Per Square Foot

Layout quality, maintenance fees, building reputation, and location can matter as much as headline price per square foot.

4. Overestimating Rental Income

Investors should underwrite conservatively and account for vacancies, maintenance, financing costs, and realistic rent assumptions.

5. Choosing Investor-Heavy Buildings Without a Plan

Buildings with high investor concentration can experience more volatility during downturns. Make sure the property still fits your timeline and risk tolerance.

6. Ignoring Transit, Walkability, and Local Demand Drivers

In slower markets, location quality becomes even more important. Units near transit, employment hubs, and daily amenities usually hold value better.

7. Buying Without an Exit Strategy

Before purchasing, define your hold period, target rent, cash flow tolerance, and resale plan. This reduces emotional decision-making in a volatile market.

What to Buy (and What to Avoid) in a Down Market

What to Consider

- Functional 1+den and 2-bedroom layouts

- Units with strong natural light and practical floor plans

- Buildings with solid management and cleaner financials

- Locations with durable end-user demand

What to Be Careful With

- Micro-units with narrow resale demand

- Buildings with unusually high maintenance issues

- Projects with weak management or litigation history

- Properties in areas with weaker transit access and low walkability

Final Takeaway

If you are asking when will Toronto’s condo market hit bottom, the better question is: what signals confirm the risk/reward is improving?

The best opportunities often appear before headlines turn positive. Focus on data, building quality, and long-term fundamentals rather than trying to time the exact bottom tick.

Tip: Track inventory, sales volume, days on market, and lease trends monthly. Those indicators will tell you more than market noise.